The Real Estate Market Took a Wild Ride Last Year

Does that mean more money for schools?

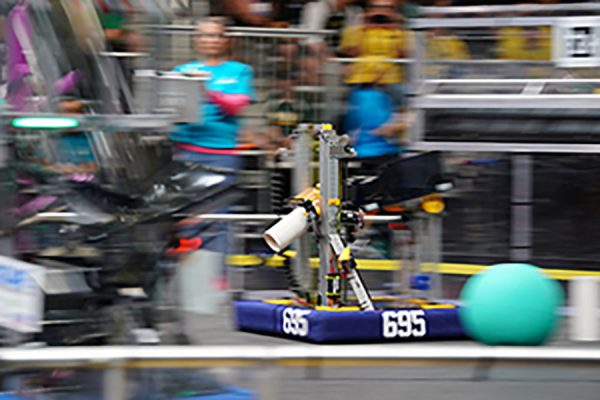

Prices rose dramatically last year for homes such as this one on Community Drive in Beachwood.

Home values nationwide increased almost 20 percent between fall 2020 and fall 2021, according to reporting by CNN.

Cuyahoga County’s increase was strong but not as dramatic, with an 8.2 percent increase during that time period. Real estate website Redfin estimates Beachwood home prices increasing by as much as 29 percent in 2021.

Others give a more modest assessment.

“On average, Beachwood homes went up 10 percent,” Beachwood City School District Treasurer and CFO Michele Mills wrote in an email.

While prices have risen in Beachwood, they have risen more in some other municipalities.

“Interestingly, in Cuyahoga County, the last three years show a much higher rate, close to 70 percent,” wrote Century 21 real estate agent Mike Ferrante, who sells property around Northeast Ohio. “Multi-family homes in Cleveland proper have increased in value as well because investors are seeking cash flow.”

“Other areas in Cleveland saw higher increases – for example, Lakewood was 24 percent [and] Fairview Park was 21 percent,” Michele Mills wrote in an email. “The overall increase for the county was on average 11 percent.”

This dramatic increase in property values would seem to be good news for the school district, since the majority of school district funding comes through property taxes; over 76% of the school district’s revenue came from property taxes in 2021, according to the school district’s annual report.

However, Mills estimates the impact will be small.

“We are estimated to receive an additional $379 thousand per year, but there is no set plan that goes into the fund balance,” Mills said. “Our community is always happy to have increases, but it amounts to 1% of our total revenues.”

Mills also cautions that taxpayers often dispute property valuations. When property assessments rise, complaints rise as well, and if the taxpayer is successful, they get taxes refunded.

“It takes years [for these appeals] to go through a system for tax appeals,” she said.

Property taxes are charged according to different rates for each community. The rates are calculated by millage, which is the amount per $1,000 of assessed property value. Each community votes for tax levies to fund schools and other public services.

According to the Cuyahoga County Fiscal Office, Beachwood’s current millage rate is $20.42 per $1,000 of assessed value, or $6,125.28 for a $300,000 home. Commercial property in Beachwood is taxed at $27.21 per $1,000.

Schools take a significant percentage of property taxes, but they also fund libraries, community colleges, park systems, health services and more.

“Every time taxes go up, the schools are blamed because we collect a great sum of money,” Mills said.

Commercial property pays more money into the school budgets because both the rates and property values are higher.

“The commercial property complaints have a larger impact [on] us because their values are greater,” Mills said. “Our [revenue] is roughly 50-50 between commercial and residential.”

Another issue is that the Ohio general assembly is considering House Bill 126, which would restrict school districts from arguing over property valuations. If passed, the bill would likely result in lower revenue overall, since property owners could still argue for reductions.

Why Did the Market Spike This Year?

Early on, the pandemic presented challenges for people trying to sell homes.

“COVID caused a large dip in sales in March, April and May of 2020,” Ferrante said. “But since then, other than changing some of our practices and protocols, COVID has not affected the market negatively.”

“It has made certain aspects more challenging, such as showings and open houses, but we have adapted our procedures to accommodate the issues,” he added.

Greg Greenspan, who moved from Solon to Reminderville in the summer of 2020, explained what it was like for him and his wife to go through the buying and selling process during the pandemic.

“Selling was [much] tougher, we had to follow certain guidelines.” Greenspan said. “[We had to] make sure people were wearing gloves and masks.”

“[It] had quite the effect when selling, he added. “There were not as many showings, open-houses had restrictions on them and it definitely affected the amount of time on the market for selling because people were nervous.”

In spite of the initial challenges, the pandemic ultimately fueled demand. With so many people quarantined and working from home, many have wanted to move from apartments to houses or from small houses to bigger houses.

At the same time, interest rates have been at historic lows, so buyers can borrow more money at low cost.

“Not only have prices risen but also the length of time it takes to sell a home has dropped significantly, down to about 12 days from a more ‘normal’ 30-40 days,” Ferrante wrote.

“It’s a sellers’ market, which means the demand is higher than the supply of homes, more buyers than sellers. This is driving up prices.” he added.

Demand in Beachwood

Demand is high in Beachwood, in part, because supply is limited.

According to the City of Beachwood official website, Beachwood had a major population growth in the 60s which led to the construction of thousands of homes, apartments, and condos. But those times have long since passed.

“Beachwood is pretty much out of land for development, so I don’t see a lot of development coming,” Ferrante wrote… “Unless not well-maintained, the way our homes are built can last virtually forever. The only concern is for buyers who want more modern floor plans and styles.”

“Instead, we’ll sometimes see older, obsolete homes [that were] torn down to make way for larger, more modern ones.” Ferrante added.

Just as home values have changed, so have the amenities that buyers are looking for. What country satisfies our essential needs, things like school systems, grocery stores, commutes to work, parks and even dog-parks.

“It just depends [on] what they are looking for. Beachwood is closer to Downtown Cleveland, the Cleveland Clinic, and University Circle,” Ferrante wrote. “But some buyers may prefer more land in which case they may prefer Solon or Orange over the smaller lots that are typically found in Beachwood.”

Affordability is also a factor for young families who might want to move to Beachwood.

“People are always moving to Beachwood because we have strong public schools,” Mills said. “For younger families, they’d like to move to Beachwood per the education system but it is out of their budget.”

“[Because of this] we end up losing [potential buyers] to neighboring counties,” she added.

Where Will the Market Go From Here?

Ferrante predicts that the market will continue to favor sellers in the near future.

“We’re still about 50 percent of the typical inventory levels, so we expect the sellers’ market to persist through 2022,” Ferrante.

However, he expects the market to calm down by next year.

“It’s hard to say, but we are already seeing signs that inventory is beginning to catch up with demand,” Ferrante wrote. “Listing inventory has been rising for a few months now, during a time of year where it traditionally drops (winter and holiday seasons).”

Ferrante believes that the Federal Reserve will gradually raise interest rates, which will make buyers more careful.

“I think the Fed is afraid to negatively affect the economy, so the increases will be slow and small,” he wrote. “My opinion is that they should be small and frequent because they are “fighting the tide” by clinging to these artificially low rates.”

“We’re expecting interest rates to rise, which could curb some of the buyer demand, causing the market to even out,” he added. “We believe by 2023, the sellers’ market will shift to more of a balanced market.”

It is unlikely that sellers will see another year like 2021, though. Last year’s rise in property values is greater than what Northeast Ohio has seen in many years.

“There have been other periods,” Mills said. “In 2004 [there was an] average increase [of] 14 percent, in 2007 it was 9 percent and again in 2001, it was 9 percent,” she said.

Carli Margolis (she/they) began writing for the Beachcomber in the fall of 2021. She covers all topics. In addition to writing for the Beachcomber,...