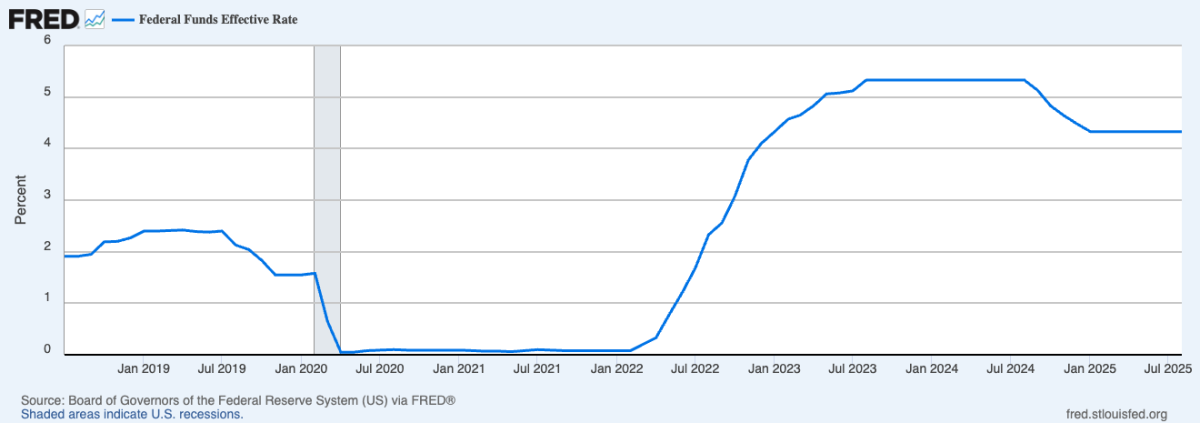

In a memo sent Feb. 20, Cuyahoga County Treasurer Brad Cromes announced that the county would be freezing its $3 million investment in Israel Bonds.

He stated that the county is facing a budget shortfall for 2025, that federal funding is uncertain, and that the county needs to keep cash on hand for unexpected expenses.

At first it might seem like Cuyahoga County’s decision to pause all long-term bond investments is all about money.

In fact, the county also paused other long-term bond investments, not just Israel bonds, supporting Cromes’ claim that the freeze is part of a broader investment strategy and not limited to one type of bond.

Cromes announced that the county would stop reinvesting in Israeli bonds until the county’s reserves reach $100 million. This pause will likely stop in September 2025.

The county says it needs to focus on short-term investments until it saves up more cash.

This sounds like responsible financial planning. After all, the county is dealing with some big bills: $25 million for jail-related expenses, $32 million to revalue real estate and nearly $98 million in unusual costs that came early in the year.

On top of that, some tax revenues are coming in late and the federal government is holding up grants including a $129 million climate funding package.

So, yes, the county needs to be careful with its money.

But that’s not the whole story.

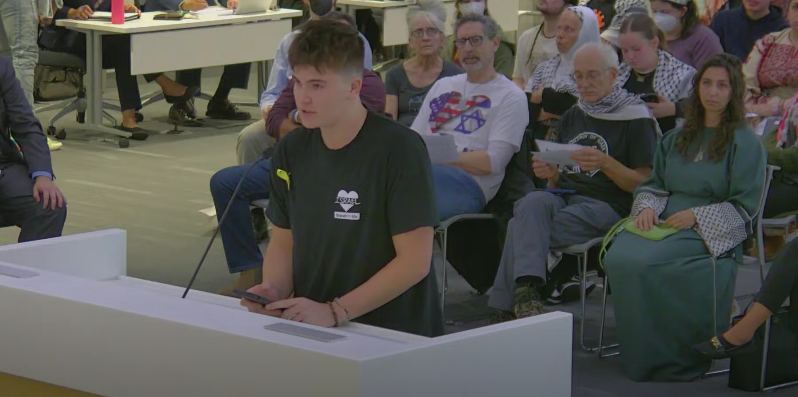

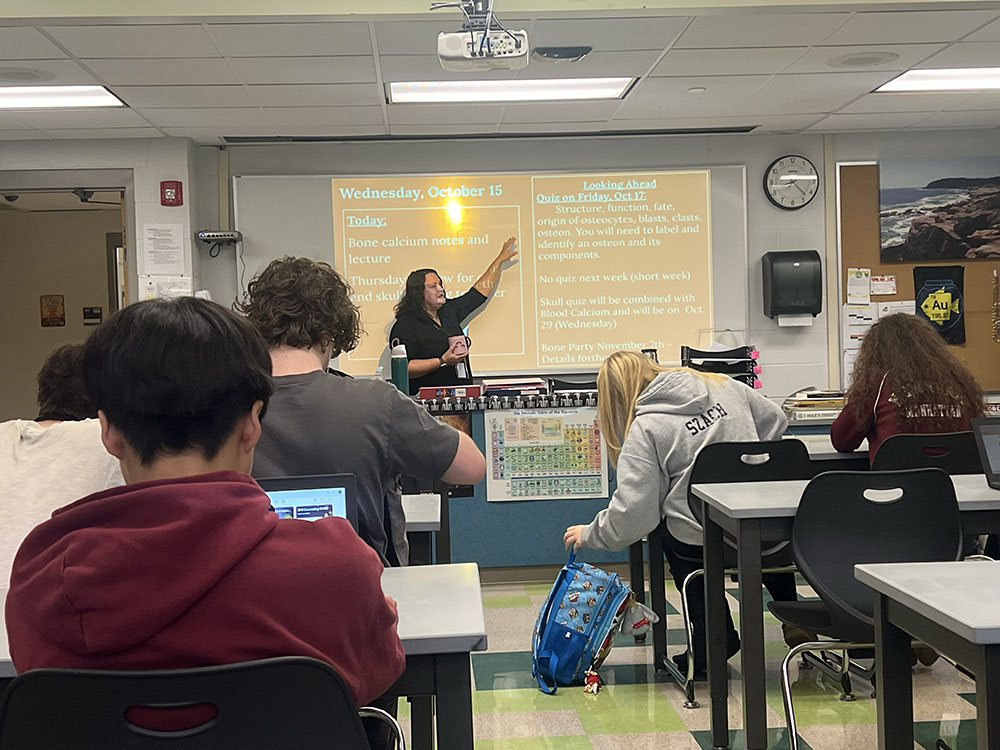

Cromes’ memo leaves out important context. Pro-Palestinian protesters had been attending County Council meetings for over 16 months prior to Cromes announcement, demanding that the county divest from Israel bonds.

One of many speakers, who identified himself as a member of the Cleveland Democratic Socialists of America, spoke out against the county’s investments in Israel.

“I am here to demand from the council that you immediately divest from Israel Bonds…” he said. [20:05]

Given that context, it becomes clear that Cromes’ announcement is not just about money. It’s about politics, pressure and the message the county is sending.

Activists had been attending Cuyahoga County Council meetings for over a year, since the conflict in Gaza escalated, calling on officials to divest from Israeli bonds.

To those activists, the Israeli bonds are a way of supporting military action and human rights violations. They argue that the county should not be involved in anything relating to the Israeli government while this conflict continues. This pressure grew strongest in the fall of 2024, with activists showing up to council meetings and yelling at leaders to divest.

In response to these protesters, pro-Israel speakers also showed up to defend the county’s investment in Israel.

So when the county decided to not reinvest their $3 million from Israeli bonds that matured in March, many saw that as a win for the divestment movement. Even though treasurer Cromes says the pause is about money and not politics, the timing makes it harder to believe what he claimed.

It’s important to look at what Israeli bonds actually are. They aren’t stocks and are definitely not risky. In fact they have been a safe investment for decades. Since they were first offered in 1951 Israel has NEVER missed a payment.

This track record is probably why Cuyahoga County decided to invest in the Israel bonds in the first place. When you are managing public money, reliability is important, and Israel bonds have consistently delivered. Our county probably saw them as a low-risk, smart investment.

If the county is truly worried about money, then they should have continued to invest in these bonds. Especially something as safe and reliable as Israeli bonds. Not reinvesting makes no sense at all.

Treasurer Cromes’ memo says the freeze is meant to avoid “new long-term reinvestment activity within the core portfolio.”

He means to focus on short term investments until things feel more stable. That’s understandable. But in December 2024 the county sold four bonds to help cover end-of-year costs and didn’t lose any money. The bonds did what they were supposed to do.

Mississippi state treasurer David McRae is one of many public officials who strongly support Israeli bonds, calling them both a safe and profitable investment.

Since 2019 Mississippi has earned more than $1.7 million from a $20 million investment, with reinvestment in 2023 earning a 4.57% return higher than comparable US treasury rates. McRae credits these returns to Israel’s strong credit rate and long history of never missing a payment, making the bonds a stable option for growing taxpayer money.

Beyond just the financial benefits, McRae also sees investing in Israel Bonds as a way to support shared values. He highlights Israel as a thriving democracy in the Middle East that protects freedoms like speech and religion, while also contributing to Mississippi’s economy through partnerships like Stark Aerospace.

For McRae, investing in Israel Bonds isn’t just about making money, it’s about standing with a key ally and supporting innovation and stability in a complex world.

Warren Buffett, one of the most respected investors in the world, has personally bought millions in Israel Bonds and hosted multiple events encouraging others to do the same.

“If you are looking for brains, energy and dynamism in the Middle East, Israel is the only place you need to go,” he told the Times of Israel in 2017.

So why stop investing in bonds that are working?

Divestment advocates view Israel as an aggressor in the conflict, when in fact, Hamas started the war with a bloody attack that killed almost 1,200 people.

BHS Senior Ori Balkan walked past pro palestinian hecklers then addressed the County Council on Oct. 10, 2024. [28:56]

“This is not a one-sided conflict,” he said. “These calls for divestment and boycott are fueled by a one-sided, hateful view of a very complex subject… Israel is a democracy that values innovation, resilience, and freedom.”

That’s a view that isn’t getting as much attention as the divestment protests. People who support Israel bonds argue that the investments are being turned into a political symbol, even though they have been a reliable way for governments to grow their money.

If people shouting at our leaders can force our county from pulling out of smart investments, what does that mean for the future? Are we going to start divesting from investments that are completely safe because they are slightly controversial?

Supporters of the divestment movement believe that Israel shouldnt receive financial support while its military is active in Gaza. This leaves out important parts of the story such as the fact that Israeli troops completely pulled out of the Gaza Strip in 2006 and gave Palestinians complete control of the area.

Then they conveniently skip over the fact that on October 7, 2023 Hamas invaded the southern Israeli border, kidnapped 250 men women and children and killed 1,200 men women and children.

At that same council meeting, a pro-Israel speaker explained that Israel has a responsibility to defend itself.

“If it were not for the hate and the wars and the terror, there would be no need for an IDF or an IDF response…” she said. “The Jewish tie to Israel is one of love, and it’s been there eternally.”

The word ‘apartheid’ has also been thrown around at these meetings and protests. But that word does not describe Israel one bit.

Israel is a wonderful democracy where 20% of the population are Arabs, those citizens have every right to vote, serve in government, and work in all places of society. Israel is a democracy, but even if it is not perfect, calling it an apartheid state shuts down thoughtful discourse.

Shown in the article Myth:Israel is an apartheid state Mansour Abbas, the head of the Islamist United Arab List (Raam) Party in Israel’s Knesset explains the differences between South Africa during the apartheid era and Israeli Democracy.

“In contrast, Israel is a democratic state, where all minorities receive equal protection under the law,” he wrote. “Alongside Jewish Israelis, Arab Israelis vote, study, work, live and serve in Parliament, the courts, the military, and government.”

The same article also points out that Israel’s founding document–which it still upholds–states that all citizens are equal regardless of race, religion or sex.

Right now it feels like the county is walking a fine line, balancing the budget or trying to avoid the controversy. But in doing so it’s sending a confusing message that even the most financially responsible bonds can be dropped because enough people demand it.

There’s no doubt that the county has tough choices to make. The economy is uncertain, and local governments are often the first to feel the impact. Still, pulling back from something that’s worked for years like Israel Bonds under the excuse of “liquidity issues” feels off. It makes it seem like political pressure is driving financial decisions, not logic or long-term planning.

Because if we start making financial decisions based on what’s popular instead of what’s smart, we risk losing focus on what really matters: stability, responsibility and fairness. And in a time when democracies everywhere are being tested, we should be careful about letting politics control our wallets.