“The Big Short” Introduces the Misfits Who Sadly Profited From the Housing Crisis

The Big Short, based on the 2010 book by Michael Lewis, is a dark, frank, somewhat depressing look into the 2008 financial crisis.

The film follows three groups of investors who, in one way or another, are aware of the coming crisis, and are trying to short (bet against) the overvalued housing market, and in doing so, are sadly planning to profit off the collapse of the economy.

Christian Bale’s performance as Michael Burry is a highlight of the film. A speed metal-loving, antisocial hedge fund manager based out of California, he has the foresight to see the coming subprime loan crisis and calculates that the market will crash in the 2nd quarter of 2007.

Going completely against popular thinking, he actually bets on the economy eventually tanking. He first has to convince bankers to create a credit default swap market for CDOs (collateralized debt obligations), which essentially means that as long as the housing market is stable, he is losing money, but when the market crashes, billions of dollars are to be made.

In the face of skepticism from the big banks, who are nonetheless happy to take his money, and anger from investors in his fund, who lose faith in his financial foresight as they watch their investments sink, Burry holds steady until his bet pays off.

If you don’t completely understand the above paragraphs, don’t feel bad. The film employs celebrities such as Margot Robbie, who starred in The Wolf Of Wall Street, and Anthony Bourdain in order to explain these complex economic concepts.

By putting the concepts in layman’s terms, Director Adam McKay helps his audience understand the financial crisis as a whole, and also helps to develop our contempt for the people who enabled the crisis to happen.

Steve Carell’s performance is also a standout. He plays Mark Baum, a hedge fund manager whose dark sense of humor, foul mouth and uninhibited anger make him a believable character who is likable in spite of his flaws.

The film also does a good job of exploring the central predicament: Shouldn’t our main characters feel bad about what they are doing?

If they succeed, it means that jobs are lost, homes are foreclosed, families are hurt, and life in America will be irrevocably changed.

This adds a layer of moral ambiguity to all of the cast’s actions, and in some cases, might increase our contempt for them.

This layer is constantly reminding us that in the real world, there really are no good or bad guys; just people doing what is best for themselves.

Wall Street is absolutely hammered in this film. From corrupt rating agencies that falsely certify the quality of the loans, to bankers who enable people to own houses they truly cannot afford via bad loans, almost every single person on Wall Street, including some of the film’s heroes, are portrayed as being morally bankrupt, selfish and decadent.

And it’s all true.

Overall, the film gives a frightening glimpse into the dark workings of our culture, which places so much value on excess in the present that we often forget to keep safeguards in place for the future.

I would give it a 10/10. It is definitely a must-see picture whether you have prior knowledge of the economic crisis or not, and it is a serious contender to win the award for Best Picture at this year’s Oscars.

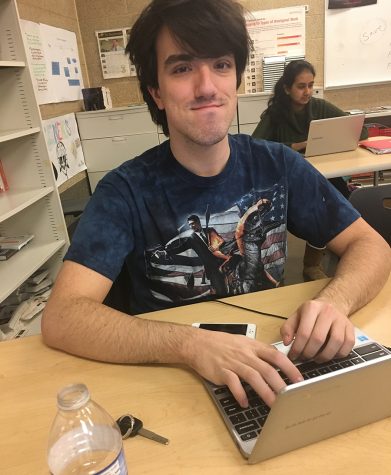

Alex Cala has been writing for The Beachcomber since the fall of 2014, when he was a sophomore. He became the opinion editor the following year. Alex tends...

![“My parents have always said that education is important. My parents are Chinese immigrants, I'm Chinese American, [and that's a] value that has always been ingrained in our community,” said Senior Lyndia Zheng, pictured with Tony Zheng](https://bcomber.org/wp-content/uploads/2025/10/DSC_4244-600x400.jpg)